Artificial intelligence has quickly moved from being a buzzword to becoming a cornerstone in various industries, including insurance. Today, AI is transforming how insurers operate, offering a smarter, faster, and more efficient way to handle tasks that were once time-consuming and labor-intensive.

From fraud detection to underwriting and customer service, AI is not just an add-on – it’s a game-changer. As 79% of principal agents are already adopting or plan to adopt AI platforms within the next six months, it’s clear that AI’s presence in the insurance world is only set to grow.

Customer Service: AI Makes Insurance More Accessible

In an industry like insurance, where customer interaction is a significant touchpoint, AI is set to revolutionise customer service. Traditionally, customers had to rely on human agents for basic inquiries, claims initiation, and other tasks. With AI-driven chatbots and virtual assistants, customer service is available 24/7, providing real-time answers to basic questions and even assisting with initiating claims. These systems can significantly reduce the response time, while also easing the burden on insurers to manually handle routine inquiries.

But AI does more than simply respond to customer queries. Machine learning algorithms allow virtual assistants to learn from interactions, improving their ability to provide accurate answers over time. This technology can personalize the customer experience, providing tailored responses that better meet customer needs. And since AI can handle the more routine tasks, human agents can focus on resolving complex issues, creating a more streamlined and efficient process.

Claims: Speed and Precision

AI in claims processing is one of the most promising areas where technology is poised to make an immediate impact. Claims, traditionally bogged down by paperwork and time-consuming reviews, can now be processed more quickly and with fewer errors. AI can rapidly analyse large sets of data – such as images, past claims, and sensor data – to provide recommendations on claims settlements in real time. This not only speeds up the process but also ensures greater accuracy.

With AI-powered machine learning, claims can be automatically assessed for potential fraud, reducing the need for human intervention until absolutely necessary. Insurers save on operational costs, and customers benefit from faster claims resolution. This shift frees up valuable time for insurance agents, allowing them to focus on higher-value tasks and improve customer satisfaction.

Fraud Detection: A New Level of Security

Insurance fraud is an ever-present concern in the industry, costing insurers more than $308.6 billion annually. Identifying fraudulent claims has traditionally been a reactive process – agents sift through data manually, searching for inconsistencies. AI has completely upended this process by using sophisticated algorithms to detect anomalies in claims data at lightning speed. AI can analyse vast amounts of data in seconds, identifying patterns that may go unnoticed by human analysts.

Machine learning systems can flag suspicious activity, allowing claims specialists to investigate further. In the long run, this not only saves insurers significant amounts of money but also builds a more secure and trustworthy relationship with customers. As AI continues to evolve, insurers can expect even more precise fraud detection capabilities.

Underwriting and Pricing: Personalization and Efficiency

Underwriting has always been one of the most complex and time-consuming parts of the insurance process. AI is transforming this area by automating data collection, improving risk assessments, and enabling insurers to offer more competitive and personalised pricing. Through the precise analysis of customer data – such as demographic information, location, and lifestyle choices – AI systems can quickly determine the best rates and the most appropriate coverage for each individual.

In addition, AI technology reduces the time needed to update and implement new pricing models. This helps insurers stay agile in a competitive market while ensuring customers receive rates that are tailored to their specific circumstances. The use of predictive analytics also allows insurers to proactively identify and address potential risks, giving them an edge in risk prevention and customer satisfaction.

Risk Prevention: Predicting the Future

One of the most significant impacts of AI in insurance is its ability to move the industry from a reactive to a proactive state. Through advanced predictive modelling, AI can help insurers anticipate potential risks by analysing historical data, environmental factors, and market trends. For example, AI can analyse data from Internet of Things (IoT) devices or a client’s claims history to provide insights into future risks, offering insurers the opportunity to address issues before they escalate.

By harnessing AI-powered data analytics, insurers can deliver more accurate risk assessments and offer tailored recommendations for mitigating risks. This forward-thinking approach improves the overall customer experience and enhances the insurer’s ability to prevent losses before they occur.

Embracing AI in Insurance – Challenges & Benefits

Implementing AI in the insurance industry presents unique challenges, especially when it comes to data security, privacy concerns, and the reliability of AI-driven models. Since insurance companies handle sensitive customer information, any integration of AI technologies must ensure that data is stored, processed, and used securely. Moreover, there are ongoing concerns about the transparency and trustworthiness of AI systems, as they sometimes lack clear explanations for their decision-making processes. These issues are critical, but the benefits of adopting AI in insurance far outweigh the potential risks.

AI in insurance offers significant advantages, such as increasing productivity, reducing operational costs, and enhancing the overall customer experience. By automating time-consuming tasks like data collection, claims processing, and underwriting, AI frees up human resources for more high-value work, resulting in smoother workflows and faster service delivery. This ability to process large amounts of data with precision allows insurance companies to operate more efficiently, improving their overall business performance.

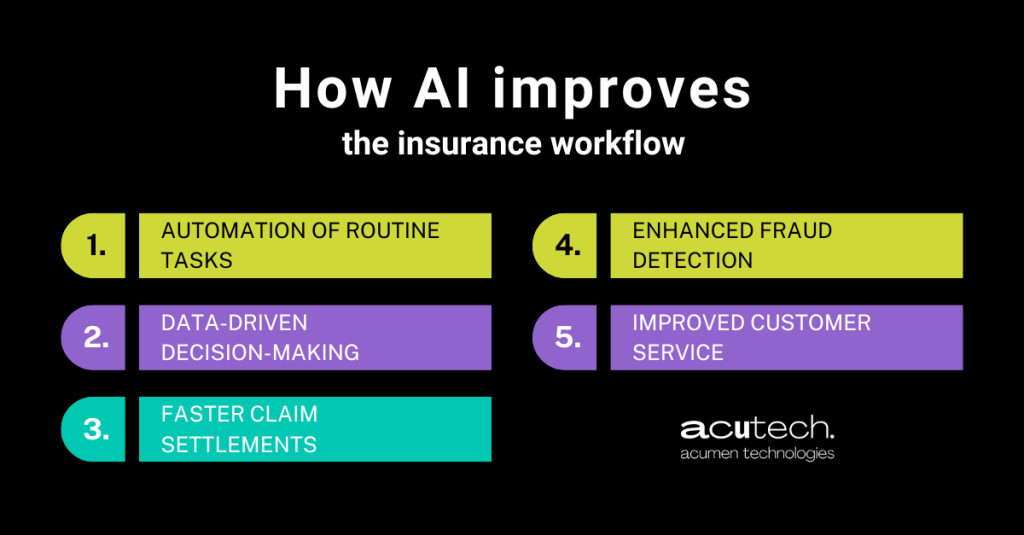

One of the key benefits of AI implementation is the reduction in human error. Manual processes often involve repetitive tasks that can lead to mistakes, especially in data entry or claims processing. With AI, these errors are minimized, ensuring greater accuracy throughout various stages of operations. This directly translates to fewer disputes, quicker claims approvals, and higher customer satisfaction. Here’s how AI improves the insurance workflow:

- Automation of routine tasks, such as policy renewals, claims submission, and document processing

- Data-driven decision-making through predictive analytics and real-time insights

- Faster claim settlements by automatically assessing damage and calculating payouts

- Enhanced fraud detection through pattern recognition algorithms, reducing financial losses

- Improved customer service with 24/7 AI chatbots handling basic inquiries and claims initiation

Additionally, AI contributes to data efficiency by integrating various data sources into one platform. This consolidation not only improves transparency but also allows insurers to gain a more comprehensive understanding of their customers’ needs and risks. Having all relevant data in one place ensures more informed decision-making and faster responses to emerging trends.

The Future of AI in Insurance

As the insurance industry continues to evolve, AI will play an even more critical role in shaping its future. From predictive analytics to advanced fraud detection, the potential for AI to optimize and streamline operations is vast. Insurance companies that fail to embrace AI risk falling behind, while those that leverage AI’s full potential will not only improve their processes but also provide better service to their customers.

With extensive experience in AI innovation and the insurance sector, we can provide truly state-of-the-art AI solutions that can help insurers enhance efficiency, detect fraud, and deliver exceptional customer service. Ready to see how AI can transform your business? Contact us today to learn more.