Digital transformation has become a cornerstone of competitive advantage, especially in mobile banking.

This is both a technological advancement and a complete reevaluation and reimagination of the importance of customer experience in banking. Let’s take a deep dive into the transformative effects of IT in mobile banking and see why the future of financial technologies is profoundly customer-centric.

The Catalysts of Change in Mobile Banking

IT innovation and financial technology are the driving forces behind the remarkable shift in how customers interact with their banks.

Mobile banking, once considered a convenience, has now transformed into an essential platform for financial engagement, thanks to advancements in digital technologies. This shift is propelled by a deeper understanding of customer experience, where the value delivered to customers goes beyond mere transactions.

Empowering Customers with Seamless Access

The advent of mobile banking has ushered in a new era of convenience and accessibility in financial services. Gone are the days of standing in long queues for basic banking transactions. Today, customers enjoy the luxury of managing their accounts, transferring funds, paying bills, and accessing a suite of financial planning tools directly from their smartphones.

This convenience has not only elevated customer expectations but also fostered a deeper relationship between customers and their banks. Banks are increasingly integrating functionalities such as voice commands and chatbots, making interactions more intuitive and efficient. The seamless access is pivotal in a digital age where time is of the essence, and it’s transforming the banking landscape into a more customer-centric model, encouraging higher engagement and more frequent interactions with financial services.

Personalization at Scale

The integration of artificial intelligence (AI) and machine learning (ML) in mobile banking platforms is revolutionizing the customer experience by enabling personalization at an unprecedented scale.

Banks can now analyze vast amounts of data in real-time to understand individual customer behaviors, preferences, and financial patterns. This deep insight allows for the delivery of customized financial advice, tailored product recommendations, and even predictive services, anticipating customer needs before they arise.

For instance, a mobile banking app might analyze spending patterns to suggest budgeting tips or recommend a savings plan suited to the user’s financial goals. This bespoke approach not only enhances customer satisfaction but also bolsters loyalty, as customers feel their bank truly understands their unique financial journey and is there to support it with personalized solutions.

Enhancing Security with Technology

As mobile banking continues to gain popularity, the importance of security in fostering trust and confidence among users cannot be overstated.

Financial institutions are leveraging cutting-edge technologies to safeguard customer data and transactions. Biometric security measures, such as fingerprint scanning, facial recognition, and voice authentication, offer a robust layer of protection that is difficult to breach.

These measures are complemented by sophisticated encryption technologies that secure data transmission, ensuring that sensitive information remains confidential. Additionally, real-time monitoring and anomaly detection powered by AI and ML algorithms play a crucial role in identifying and mitigating potential threats before they can cause harm.

The multifaceted approach to security enhances the safety of mobile banking but also reassures customers, encouraging the adoption of additional services for their financial management needs.

Redefining Customer Service through Digital Channels

The journey of transforming mobile banking experiences revolves around redefining customer service. This is achieved by integrating user-centric design principles with cutting-edge technology to create intuitive, engaging, and secure banking applications.

- Frictionless User Experiences: The cornerstone of a successful mobile banking apps is its ability to offer a frictionless user experience. This involves creating interfaces that are not just visually appealing but are also straightforward and intuitive to navigate.

The goal is to minimize or eliminate any hurdles that customers might face while performing their banking tasks, whether it’s checking their balance, making payments, or setting up new accounts. A key strategy in achieving this is the use of responsive design principles that ensure the app functions seamlessly across various devices and screen sizes, coupled with personalized settings that allow users to customize their experience according to their preferences. By prioritizing the elimination of friction points, banks can significantly enhance user satisfaction and encourage the continuous use of their mobile banking services. - Real-Time Support and Engagement: Another critical aspect of redefining customer service in mobile banking is the provision of real-time support and engagement. The integration of chatbots and AI-driven support systems has revolutionized how customer queries and issues are addressed, providing assistance around the clock without the need for human intervention.

These intelligent systems are capable of handling a wide range of tasks, from answering frequently asked questions to guiding users through complex banking processes.

Furthermore, they are designed to learn from each interaction, continuously improving their ability to serve customers effectively. This not only ensures that users have access to support whenever they need it but also frees up human customer service representatives to handle more complex inquiries, improving overall service efficiency. - Innovative Services and Features: The continuous introduction of innovative services and features is what keeps mobile banking at the forefront of financial technology. Features like mobile check deposits, which allow users to deposit checks using their smartphone cameras, and real-time notifications for transactions and potential fraudulent activity, are transforming how customers interact with their finances.

Moreover, banks are increasingly incorporating integrated financial wellness tools directly into their apps. These tools can provide users with insights into their spending patterns, offer budgeting advice, and even suggest ways to save money. By offering these innovative features, mobile banking apps not only make financial management more accessible but also more engaging, empowering users to take control of their financial health in ways that were previously not possible.

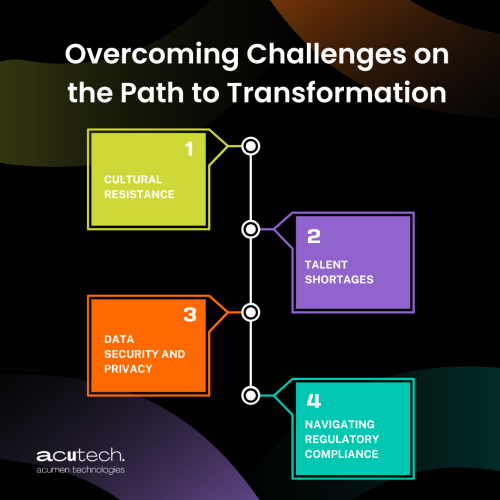

Overcoming Challenges on the Path to Transformation

The journey towards digital transformation in mobile banking, though laden with potential benefits, presents a multifaceted set of challenges for financial institutions. These problems range from internal organizational obstacles to external regulatory and security concerns.

- Cultural Resistance: One of the primary internal challenges is overcoming the cultural resistance within organizations. Financial institutions, especially those with a long history, often have deeply ingrained traditional processes and mindsets that can be resistant to change. To navigate this, banks must foster a culture of innovation and agility, encouraging employees to embrace digital transformation as an opportunity for growth and improvement. Leadership plays a crucial role in this endeavor by setting a vision for the future and actively supporting teams through the transition.

- Talent Shortages: Another significant challenge is the talent shortage in crucial digital technologies such as artificial intelligence (AI), machine learning (ML), blockchain, and cybersecurity. As banks seek to innovate and implement advanced digital solutions, the demand for skilled professionals in these areas exceeds supply. Financial institutions may need to look into training and developing existing employees, engaging with external partners, or exploring innovative hiring strategies to bridge this gap.

- Data Security and Privacy: Ensuring the security and privacy of customer data is paramount in transforming digital banking. With the increasing frequency and sophistication of cyber threats, financial institutions must invest in advanced security measures and technologies to protect sensitive information. This includes encryption, two-factor authentication, and continuous monitoring of systems to detect and respond to threats promptly. Additionally, banks must ensure that they are transparent with customers about how their data is used and protected, building trust and confidence in their digital services.

- Navigating Regulatory Compliance: The financial sector is heavily regulated, and digital transformation initiatives must be designed to comply with a complex web of laws and regulations. This includes regulations related to data protection, financial reporting, and anti-money laundering, among others. Navigating this regulatory landscape requires a proactive approach, with banks needing to stay informed about changes in laws and regulations, and ensuring that digital solutions are adaptable to meet these requirements. Collaboration between legal, compliance, and digital transformation teams is essential to ensure that innovation does not come at the expense of compliance.

A Customer-Centric Future

As we can see, the future of mobile banking is inherently customer-centric. Financial institutions that prioritize the customer experience in their digital transformation efforts will set new standards in the industry, which involves not only leveraging the latest technologies but also cultivating a culture of innovation, empathy, and customer focus within the organization.

Transforming mobile banking experiences is changing the way customers interact with their financial institutions. By focusing on customer-centric design, personalization, and security, banks can enhance customer satisfaction and loyalty, paving the way for a future where mobile banking is an essential part of their customers’ financial well-being.

Are you looking to redefine the mobile banking experience with cutting-edge, customer-centric solutions? Contact us and discover how our team of experienced software engineers can help you create banking and financial apps that will resonate with your customers.