Over the last decade, cybersecurity has emerged as a pivotal cornerstone for financial institutions, protecting sensitive data and transactions in the age of internet banking and fintech disruptors.

The changing landscape of cybersecurity, marked by increasing ransomware attacks and high-profile vulnerabilities, calls for a radical transformation in the way financial institutions safeguard their digital operations.

Let’s get to the bottom of it!

The Rising Threat of Cyber Attacks

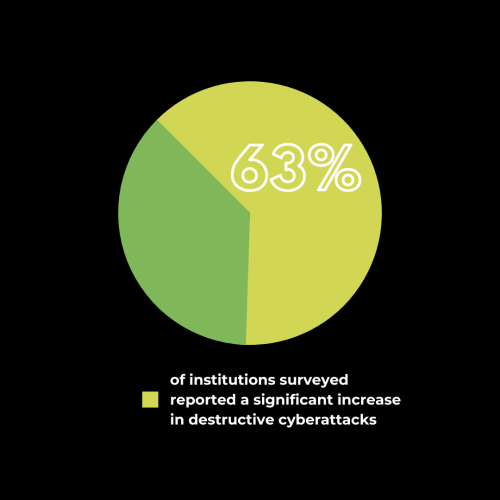

A recent report by VMware reveals a stark reality: financial institutions are under siege.

A staggering 63% of institutions surveyed reported a significant increase in destructive cyberattacks. These attacks are not just infiltrating systems; they’re leaving a trail of digital destruction in their wake, deleting data, damaging hardware, and disrupting networks.

New Age Threats: Island Hopping and Supply Chain Attacks

But that’s not the only concern. The advent of island hopping attacks has added a new dimension to the cybersecurity challenge.

Island hopping is a devious tactic where attackers target a company’s partner network instead of launching a direct assault.

Remember the Target data breach in 2017? Hackers found their way into Target’s data through a third-party vendor, Fazio Mechanical Services. Today, the prevalence of such supply chain attacks is on the rise, keeping cybersecurity professionals on their toes.

The Fintech Challenge

The surge of fintech applications has further compounded these cybersecurity concerns.

The aforementioned VMware report highlights that 94% of financial-industry security leaders have experienced an API attack through a fintech application, with 58% noting an increase in application security incidents overall.

Add Your Heading Text HereAThe Road to Cybersecurity Maturity

So, what are financial institutions doing to counter these threats?

As we move into 2024 and beyond, financial institutions are intensifying their efforts to counter evolving cyber threats. While the focus in previous years was on ramping up cybersecurity budgets by amounts of 20-30%, the coming years demand a more nuanced approach.

Investments are increasingly being channeled into advanced areas like extended detection and response (XDR), workload security, and mobile security. The incorporation of AI and heightened automation is also anticipated to play a crucial role in the surge of financial threats in 2024. Alongside these, threat intelligence and managed detection and response (MDR) remain pivotal, with a growing emphasis on proactive strategies like threat hunting, which over half of the companies are investing in.

However, countering cyber threats in the financial sector isn’t just about financial investment. It requires a comprehensive and agile cybersecurity strategy. This includes maintaining comprehensive network visibility to detect anomalies, leveraging automated security solutions to respond to threats efficiently, and ensuring flexible security controls that can adapt to rapidly changing IT architectures.

In 2024, the cybersecurity landscape in the financial sector is expected to confront challenges such as the exploitation of direct payment systems, a resurgence of banking trojans, and a rise in backdoored open-source packages. The criminal ecosystem is also predicted to become more fluid, with cybercriminals frequently switching between groups or working for multiple groups, posing additional challenges to law enforcement efforts.

As such, for financial institutions, this evolving scenario underscores the need for a proactive and innovative defense strategy that can adapt to these dynamic threats and safeguard both their operations and customers.

Bridging the Cybersecurity Skills Gap

The importance of a skilled workforce cannot be overstated.

With the scarcity of cybersecurity specialists, investing in training and reskilling initiatives is crucial. Programs like the Fortinet Training Institute, which aims to train 1 million people by 2026, are instrumental in bridging the cybersecurity skills gap.

Regulatory Challenges and the Road Ahead

Despite these advancements, the regulatory landscape remains a formidable challenge. A recent International Monetary Fund (IMF) survey reveals that 56% of central banks or supervisory authorities lack a dedicated national cyber strategy for the financial sector.

A staggering 68% do not have a specialized risk unit within their supervisory department. This lack of regulatory framework and specialized units to tackle cybercrime only exacerbates the challenges faced by financial institutions in safeguarding their digital assets.

Conclusion

In conclusion, it is paramount that banks and other financial institutions adopt a holistic, informed, and agile approach to cybersecurity.

From leveraging innovative tools and technologies to investing in the training and reskilling of their workforce, these steps are integral to ensuring the security and integrity of digital banking platforms. Remember, the stakes are high, and the safety and security of your financial assets are on the line.

Are you looking to improve your cybersecurity posture? At AcuTech, we possess the expertise and tools to help you navigate the complex landscape of digital finance cybersecurity.

Don’t leave your institution’s security to chance. Reach out to us today, and let’s work together to safeguard your digital assets and ensure a secure, resilient future.