Today’s customers seek a holistic experience that blends seamlessly with their digital lifestyles, meaning that for instance, they want to see more advancements brought about by trends such as contactless payment.

Businesses must now think beyond transactions to create engaging, intuitive experiences that resonate with the mobile-first generation, highlighting the importance of real-time payment technology in everyday commerce.

Digital economy is reshaping the way we transact every day. The way this shift of digital payment transformation is unfolding makes businesses race to adapt to a landscape where multi-channel delivery is just the starting point.

The real game-changer? Seamless, customer-driven interactions, especially through mobile devices, which are pivotal in mobile payment adoption. As we delve deeper, it’s clear that digital transformation is not only changing the way we make purchases and payments but also redefining the entire customer experience.

Beyond Transactions: The New Customer Engagement

In this 21st century, we can no longer view transactions as a mere exchange of money for goods or services.

Technological Innovations in Payments

The surge in digital payments is heavily underpinned by technological advancements. APIs (Application Programming Interfaces) are pivotal in this transformation, offering streamlined integration of various financial services. They enable seamless connections between different banking systems, enhancing the flexibility and range of digital payment options.

Blockchain technology, known for its association with cryptocurrencies, plays a significant role in ensuring the security and transparency of digital transactions. Its decentralized nature offers a new level of security against fraud and cyber threats, making digital transactions more trustworthy.

Real-time payments are another cornerstone of this evolution. Unlike traditional payment methods that involve processing delays, real-time payments offer instant transfer and clearance of funds. This immediacy mirrors the convenience of cash transactions but in a digital format, redefining the concept of ‘instantaneous’ in the financial world. This speed and efficiency are vital in today’s fast-paced economy, where consumers and businesses alike expect quick and reliable transaction processing.

Emerging Trends in Digital Payments

In this rapid evolution, why do only a few initiatives hit the mark? The answer lies in understanding the forces reshaping payments.

The banking industry’s digital-first approach blurs traditional lines, converging various mediums into a unified digital service. This shift, however, can catch many organizations off-guard, given its pace and scale.

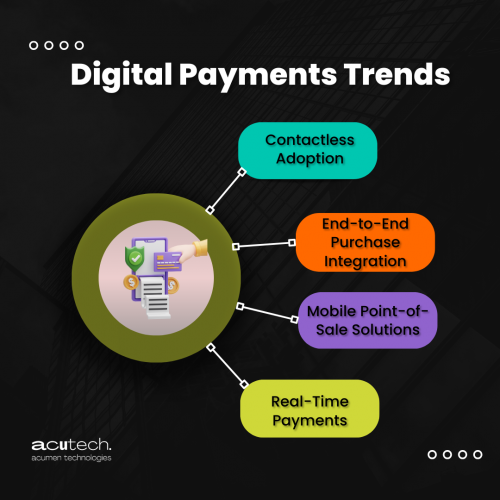

Several trends are shaping the future of digital payments:

- Contactless Adoption: This trend is seeing exponential growth, particularly in Europe. The convenience and speed of contactless payments have led to their widespread acceptance, both in retail and public transit systems. This surge is not just limited to contactless cards but also extends to mobile NFC and wearable technology, offering a touch-free, secure transaction experience.

- End-to-End Purchase Integration: The integration of payment systems into the entire customer journey marks a significant shift in digital commerce. This trend goes beyond the transaction itself, embedding payment solutions in various stages like product exploration, selection, and post-purchase rewards. Services like digital wallets are leading this integration, offering a unified platform for managing purchases, loyalty points, and user preferences.

- Mobile Point-of-Sale Solutions: The rise of mobile point-of-sale (M-PoS) systems, exemplified by companies like Square, is transforming payment experiences at the retail level. These solutions enable merchants, particularly small businesses and micro-merchants, to accept card payments anywhere, turning smartphones and tablets into versatile payment terminals. This mobility is not just enhancing customer convenience but also democratizing access to digital payment tools for sellers of all sizes.

- Real-Time Payments: Offering immediate fund transfer and availability, real-time payments are changing the way we perceive electronic transactions. Unlike traditional delayed processing, these systems provide instant payment completion, mirroring the immediacy of cash transactions but with the security and convenience of digital technology.

The Rise of Digital Ecosystems

These trends aren’t just standalone phenomena; they’re contributing to the creation of expansive digital ecosystems.

- Consumer-Driven Ecosystems: Platforms like Facebook and Twitter are evolving into spaces where commerce and payments are seamlessly integrated into social interactions. Users can engage in commercial activities, making these platforms more than just social networking sites.

- Retailer-Driven Ecosystems: Specific to stores or brands, these ecosystems, like Starbucks’ mobile app, are changing how customers interact with businesses. They combine browsing, ordering, payment, and loyalty programs into a single, streamlined mobile experience.

These ecosystems represent the next phase of digital connectivity, where payment and commerce become integral parts of daily digital interactions, reflecting the growing trend of blending physical and digital retail experiences.

Market Size and Adoption Challenges

The digital payment market, while growing, faces the inertia of traditional payment methods. Cash and cards are deeply entrenched in consumer habits and financial systems.

Yet, the scope for digital payment adoption is significant. A shift of even 10% from conventional methods to digital platforms can create a ripple effect, amounting to hundreds of billions of transactions globally every year.

This potential underscores the need for a strategic approach in transitioning consumers and businesses towards digital payment methods, balancing the familiarity of traditional methods with the efficiency of digital solutions.

Encouraging Mobile Payment Adoption

Consumer behavior is the cornerstone of mobile payment adoption. The initial hesitance often stems from concerns about security and privacy, coupled with the inertia of established payment habits. However, once consumers experience the convenience and efficiency of their first mobile payment, a shift in preference often occurs, leading to regular use.

To facilitate this transition, it’s crucial for businesses and payment providers to emphasize the ease, security, and added value of mobile payments, addressing concerns while highlighting benefits. This approach can help in gradually shifting consumer preferences towards mobile payment options.

The Future Payments Landscape

Looking five years ahead, we can anticipate a significant decline in physical cash transactions and a rise in mobile-driven contactless transactions.

This future landscape will likely feature account-driven payments distinguished by enhanced security and convenience, facilitated by emerging technologies like APIs.

Conclusion

Banks and financial institutions must leverage their expertise in payments and combine it with digital acumen to succeed in this transforming landscape.

The journey from traditional to digital payments requires not just external innovation but also internal capability building.

AcuTech is here to help. Contact us to explore how our digital payment solutions can benefit your business.